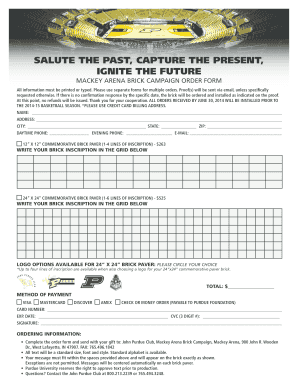

NC DoR RO-1062 (Formerly OIC-1062) 2010 free printable template

Show details

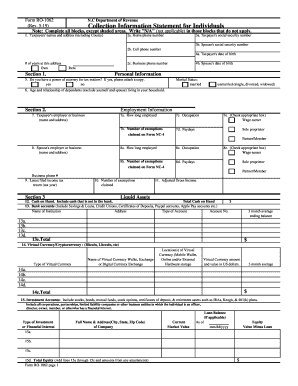

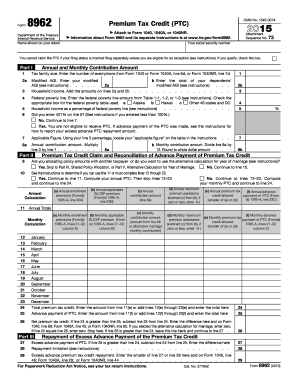

PRINT CLEAR Form RO-1062 N.C Department of Revenue Web-fill Rev. 4-10 Collection Information Statement for Individuals Note Complete all blocks except shaded areas.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC DoR RO-1062 Formerly OIC-1062

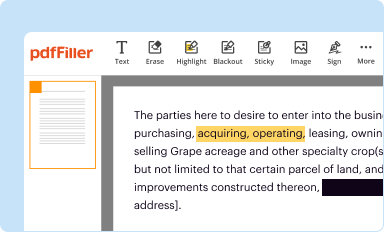

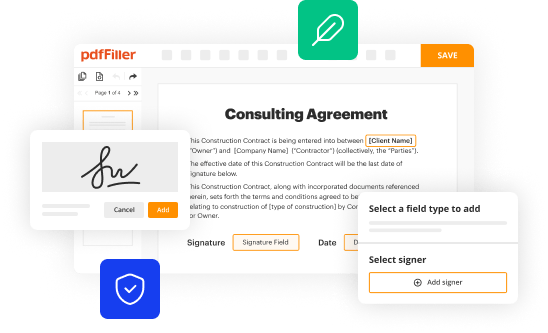

Edit your NC DoR RO-1062 Formerly OIC-1062 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC DoR RO-1062 Formerly OIC-1062 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NC DoR RO-1062 Formerly OIC-1062 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NC DoR RO-1062 Formerly OIC-1062. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC DoR RO-1062 (Formerly OIC-1062) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC DoR RO-1062 Formerly OIC-1062

How to fill out NC DoR RO-1062 (Formerly OIC-1062)

01

Begin by downloading the NC DoR RO-1062 form from the NCDOR website.

02

Fill in your personal information in the designated sections, including your name, address, and contact details.

03

Provide your Social Security number or Taxpayer Identification Number.

04

Specify the type of request you are making with respect to your NC income tax return.

05

Carefully read and follow any specific instructions provided at the top of the form.

06

If applicable, include any necessary documentation to support your request.

07

Double-check all entries for accuracy.

08

Sign and date the form before submission.

09

Submit the completed form to the appropriate NCDOR address or via the specified electronic method.

Who needs NC DoR RO-1062 (Formerly OIC-1062)?

01

Individuals or entities seeking to claim a refund of overpaid taxes in North Carolina.

02

Taxpayers who need to correct a previously filed income tax return.

03

Anyone who is making a formal request for a tax-related matter with the NC Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get IRS paper forms?

These forms and publications are available on the Internet, on CD-ROM, through fax on demand, over the telephone, through the mail, at local IRS offices, at some banks, post offices, and libraries, and even at some grocery stores, copy centers and office supply stores.

What form do I use for non resident income tax in North Carolina?

If you were a Nonresident or Part-Year Resident and received income from North Carolina sources, complete Form D-400 Schedule PN, 2022 Part-Year and Nonresident Schedule to determine the percentage of total gross income from all sources that is subject to North Carolina tax.

Where can I get North Carolina tax forms?

To download forms from this website, go to NC Individual Income Tax Forms. To order forms, call 1-877-252-3052. Touch tone callers may order forms 24 hours a day, seven days a week. You may also obtain forms from a service center or from our Order Forms page.

What form do I use to file NC state taxes?

Your North Carolina income tax return (Form D-400).

What is a collection information statement for individuals?

The IRS uses Collection Information Statements (Forms 433-F and 433-A) to gather financial information from taxpayers, including people who are self-employed. These forms ask for your monthly income and expenses and the value of any assets you have, such as bank accounts, real estate, stocks, etc.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete NC DoR RO-1062 Formerly OIC-1062 online?

With pdfFiller, you may easily complete and sign NC DoR RO-1062 Formerly OIC-1062 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How can I edit NC DoR RO-1062 Formerly OIC-1062 on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing NC DoR RO-1062 Formerly OIC-1062.

How do I fill out NC DoR RO-1062 Formerly OIC-1062 on an Android device?

Use the pdfFiller Android app to finish your NC DoR RO-1062 Formerly OIC-1062 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is NC DoR RO-1062 (Formerly OIC-1062)?

NC DoR RO-1062 is a form required by the North Carolina Department of Revenue for the reporting and reconciliation of certain tax information, previously known as OIC-1062.

Who is required to file NC DoR RO-1062 (Formerly OIC-1062)?

Taxpayers who are undergoing a specific process related to tax relief, such as those who have entered into an Offer in Compromise agreement, are required to file NC DoR RO-1062.

How to fill out NC DoR RO-1062 (Formerly OIC-1062)?

To fill out NC DoR RO-1062, taxpayers must provide accurate financial information, details of their tax liability, and any pertinent documentation that supports their request for tax relief.

What is the purpose of NC DoR RO-1062 (Formerly OIC-1062)?

The purpose of NC DoR RO-1062 is to document and assess the taxpayer's financial situation in order to determine eligibility for tax relief under the Offer in Compromise program.

What information must be reported on NC DoR RO-1062 (Formerly OIC-1062)?

Required information on NC DoR RO-1062 includes personal identification details, income, expenses, assets, liabilities, and any other specific financial information that may affect the taxpayer's eligibility for relief.

Fill out your NC DoR RO-1062 Formerly OIC-1062 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC DoR RO-1062 Formerly OIC-1062 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.